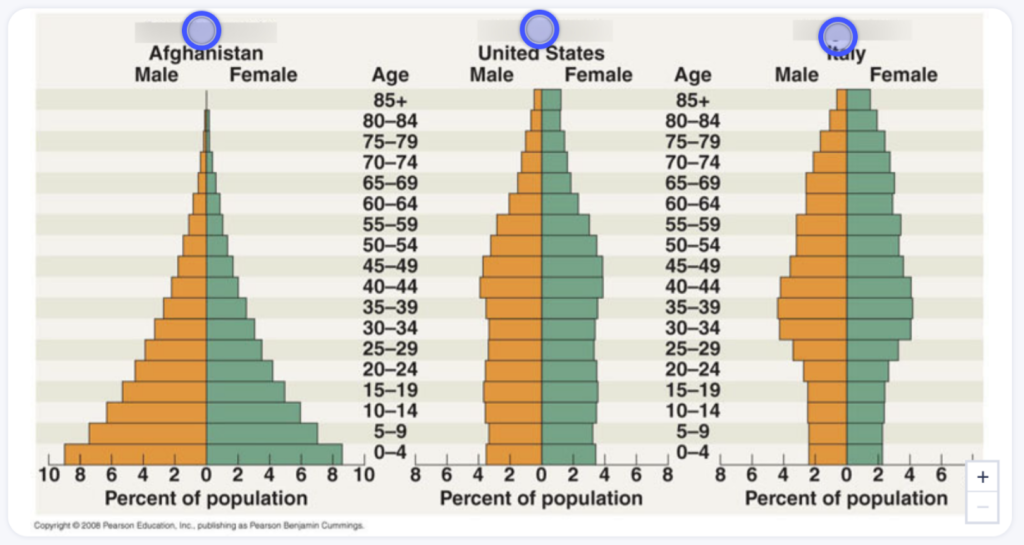

As you can observe, the elderly will equally number the young in the USA. Lets look at a sideways bar chart of the USA population. And observe comparisons with other countries.

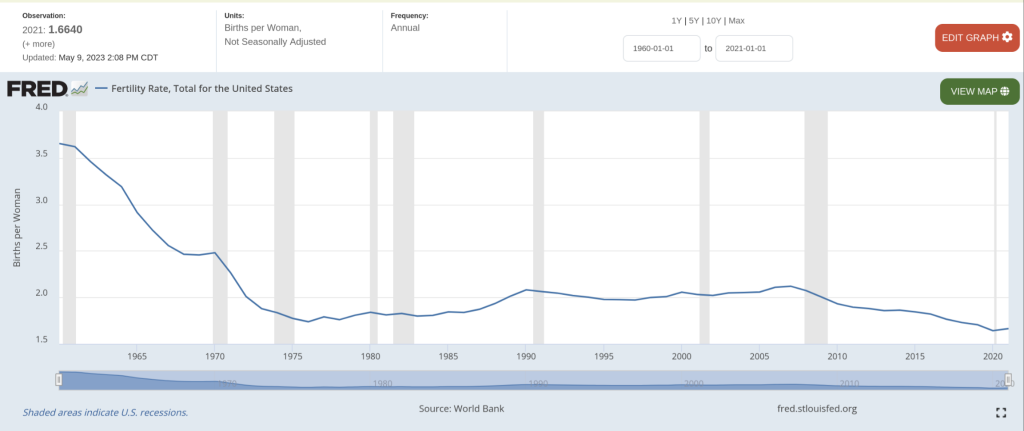

Our social safety networks in the USA are built towards a certain replacement rate, which is failing to occur. There has been negligible net population growth, and the only population growth observed is through immigration.

Italy, a country once known for its big families gathered around the dinner table, is facing a crisis of unparalleled proportions.

For the first time, the number of births in a year fell below 400,000 – representing an average of 1.25 babies per woman, according to official figures for 2022.

This means that the replacement rate is now negative, since the number of deaths currently exceeds the number of births – 12 deaths for every seven births.

What will happen is that typical retirement accounts, such as pension funds, or social security, or other funds allowing the elderly and disabled to retire. These funds will exhaust themselves within a decade, causing an entire generation of people who will have to “work until they drop”

Healthcare systems will begin denying coverage to people getting sick, and there is already a shortage of nursing and physician graduates observable in the state college graduate systems, due to the fear of pandemics, and other factors. Observable graduation rates have fallen by 50% in the last 4 years in the health professions.

Furthermore if a large scale war breaks out, there will be nobody to replace the fallen, and it only takes one loss for catastrophic damage.

This will limit the index fund market ability to grow further which is a convoluted cause and effect issue with many variables. The legacy industrial giants, USA & Japan, will be replaced by other nations who do not have these demographic problems.

A question was asked regarding “Will birth shortages defeat capitalism?” The answer is no, capitalism will continue to exist, it’s just that those people will no longer be alive for this experience.

Capitalism, as an economic system, is not inherently defeated by birth shortages. While a decline in population can lead to labor shortages and potentially impact economic growth, it does not render the capitalist system inoperable. Capitalism can still function in a society with a declining population, although it may need to adapt to new circumstances, such as increased automation or changes in resource allocation. It is essential to consider multiple factors and viewpoints when assessing the impact of birth shortages on economic systems.

The USA through the chips act has seen a failure to materialize it’s congressional goals, due to lack of laborers, there is a shortage of military men of 50,000 men in the recruitment for the military, as well as a 200,000 laborer shortage in the construction workforce.

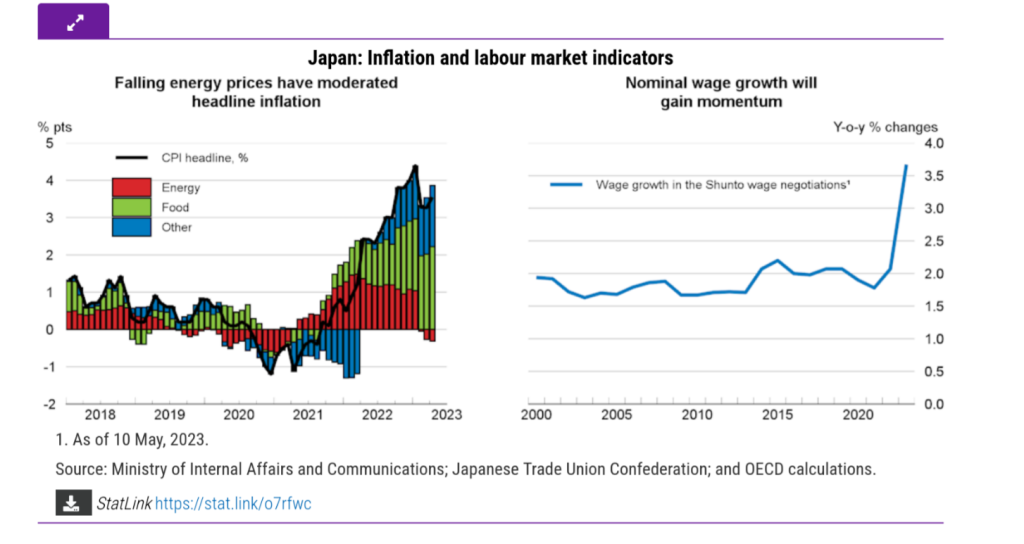

Here is a link to Japanese wage growth. This is due to printing of money and subsidies for energy, the Japanese government debt is significantly increasing year after year causing inflation. Due to inflation the wage growth may be 3.5% due to a combination of shortage of workers, but factored in with inflation is an actual growth rate of wages of -1%

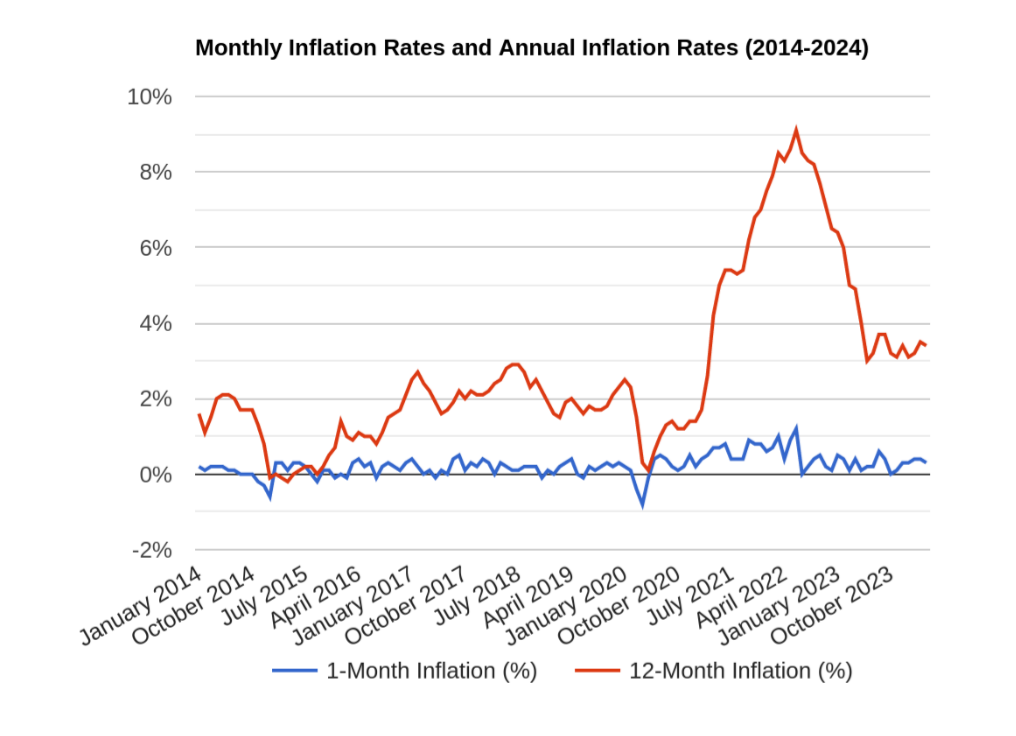

Here is the U.S. inflation: This chart is misleading, although inflation has slowed if we take a Reimann sum of the inflation since 2020, it is about a 24% of increase in commodity prices.

Statistica.com shows a 24% increase in food sales retail since 2020 also.

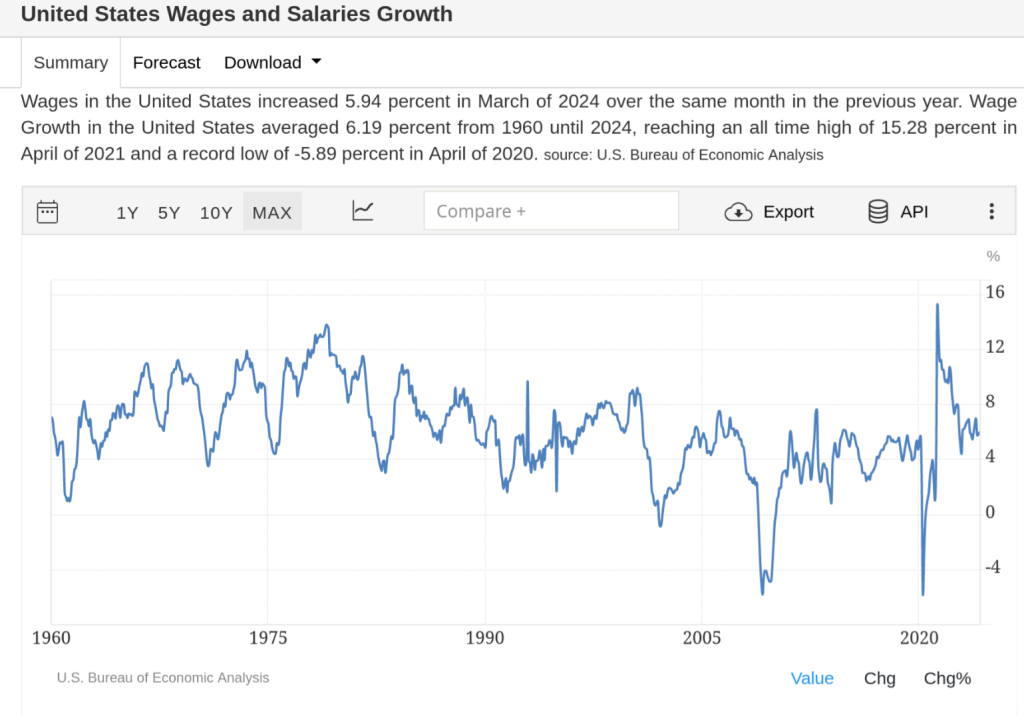

So on paper it looks good, the wages seem to grow right? Wrong, as I showed earlier we have Reimann sum of 24% since 2020 of price inflation for commodities, yet wages are only increasing at 6% per year leaving an uncalculated negative sum of real wage growth of dollar purchasing power.

In conclusion it’s very difficult to understand cause and effect and it’s interaction with world events, changes in population, but the final prediction is eventual capital flight to more stable areas with better economic conditions, of population growth, cheap energy, and stable pensions. Making areas such as Italy, California, Japan, and New York unreliable places for investment.